Comparing ESOP Policies of Indian and US Startups

Over the last couple of weeks, I have come across some horrible ESOP stories on Twitter. This tweet in particular stands out.

Although, I am sure that few of them are phantom stories with no basis in reality. Twitter’s today I met a startup employee with horrible ESOP experience is the LinkedIn’s today I met a cab-driver who changed how I think about life.

Then, I also came across Kunal Shah’s tweet where he pointed out the zero-sum mindset and lack of generosity among Indian founders. He raised some important questions:

What %age of employees in unicorns have been given ESOPs?

How frequent are ESOP exits for ex-employees?

What is the %age ESOP Pool Size in Indian startups?

All of these horror stories and reading Kunal’s bold accusation on the mindset of Indian founders gave me a solid trigger to do a deep-dive on this topic.

DISCLAIMER: I am writing this to objectively compare the ESOP policies of India and US startup ecosystem using the data available on this topic. If a data-point is incorrect, please point it out. If you disagree with the conclusion and have alternate data points to back it up, please share it.

ESOP Pool Size

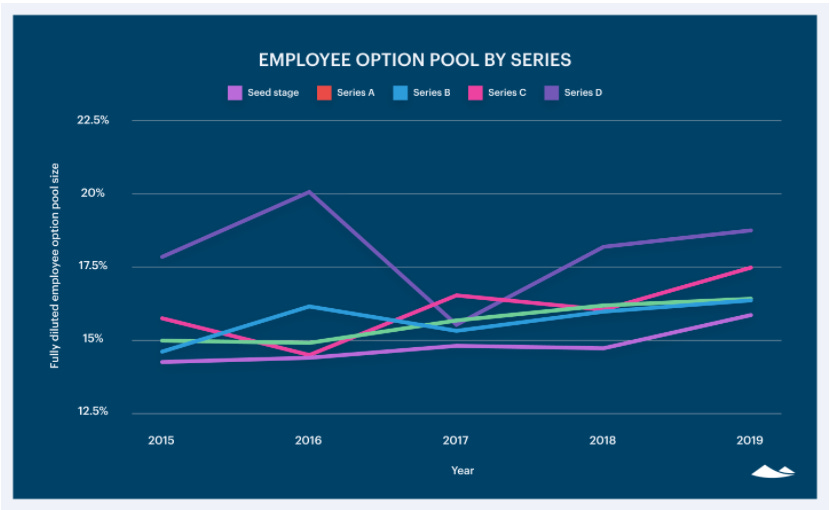

USA: On an average, the ESOP Pool size is ~15% during Seed and Series A funding round. Also, as the companies move towards Series C and D, there is an up-trend in ESOP Pool sizes.

Now, let’s look at the same graph for Indian startups.

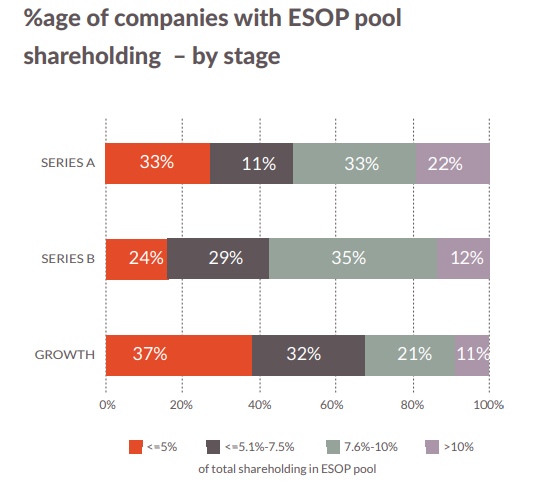

Series A: 78% startups have ESOP Pool size < 10%, 33% have < 5%.

Series B: 88% have ESOP Pool size < 10%.

Growth Stage: 90% have < 10%.

Interestingly, this is reverse of what we see in US. As the company grows, the ESOP Pool size decreases in India.

As per the Trifecta Capital report, “The presence of multiple equity investors on the cap table who usually have a target ownership in mind while investing, leads to a gradual erosion in the size of the ESOP pool”.

The average %age ESOP Pool size across Series C/D round in US is 16-17%, however, the same number for startups across Growth rounds in India is 7.5-8%.

Employees eligible for ESOP

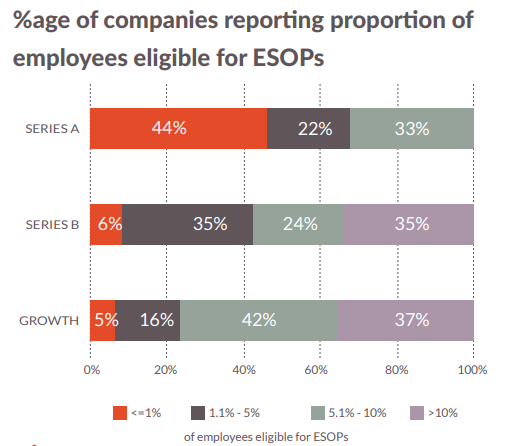

44% of Series A funded startups reported that less than 1% of the company employees are eligible for ESOPs.

The risk post series-A is still substantial. An employee is taking a bet by joining a startup at this point and rewarding less than 1% of employees is concerning.

Before going further, let’s have a look at the 45 companies who participated in this study done by Trifecta capital.

These 45 companies represent the who’s who of Indian startup ecosystem, and if this is the situation at the top 1-2% startups, then the numbers will probably be worse down the startup food-chain.

What about Unicorns?

Entrackr recently published an article on the ESOP Buybacks in Indian startup ecosystem for the year 2021. The total ESOP buybacks amounted to 440 M$, an eightfold jump from previous year.

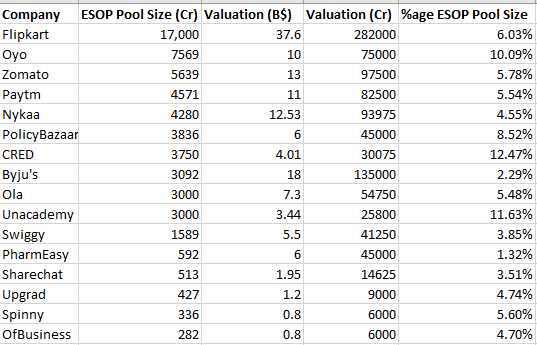

In it, they also published ESOP Pool sizes of some of the biggest Indian startups. I have used the same information to prepare the below table.

Except Oyo, PolicyBazaar, Cred and Unacademy, almost all late-stage startups have ESOP Pool size in the 5-6% range. The nos for Byju’s and Pharmeasy (2.29% and 1.32%) are quite low.

There are few important caveats with the above data which I would like to address here:

As per this livemint article, Paytm had more than doubled its ESOP Pool from 24.09 mn to 61.09 mn equity options in Sept, 21. This will effectively double their ESOP Pool Size. However, Entrackr reports Paytm’s total pool size as 4571 crores.

The ESOP Pool sizes reported can be from a period when the company had a lesser valuation (compared to present). For ex, in the case of Spinny and OfBusiness, I have considered the valuation at the time of ESOP pool size announcement. Both are valued above 1 B$ currently.

CRED recently increased their ESOP Pool Size from 357 M$ to 500 M$ and is also rumored to be raising new capital at 5 B$ valuation. Given the new valuation, the new %age ESOP Pool size will be 10%, which is still significantly better than others.

Conclusion

The %age ESOP Pool size of Indian startups across Series A, B or Growth rounds is significantly less compared to USA. When we look at the ESOP Pool sizes of late-stage startups, the percentage is even worse. What we can conclude without a doubt is that employees in Indian startups are not rewarded as handsomely as employees in western counterparts. This could be due to multiple reasons. Firstly, Founders are not being generous (enough) when it comes to rewarding early supporters in their startup. Secondly, the minimum ownership requirements from late-stage investors also lead to erosion of ESOP pool sizes. What’s strange and striking here is that the data for US paints a totally opposite picture where pool sizes grow as the company matures. I am assuming the investors there also have the same minimum ownership requirements but why doesn’t that translate to lower ESOP pool sizes. One possible reason could be the stiff competition for talent between late-stage private companies and public companies in US (FAANG). Late-stage startups in India do not face such extreme pressure from their public counterparts (basically, non-existent at the moment) and offering a higher salary mostly gets the jobs done.

Note: Data Source and References.